We're a team of wedding, elopement and portrait photographers who put community over competition. We provide tips and resources for Photographers looking to up-level their businesses.

We're here to help When you join The Photography Business Academy

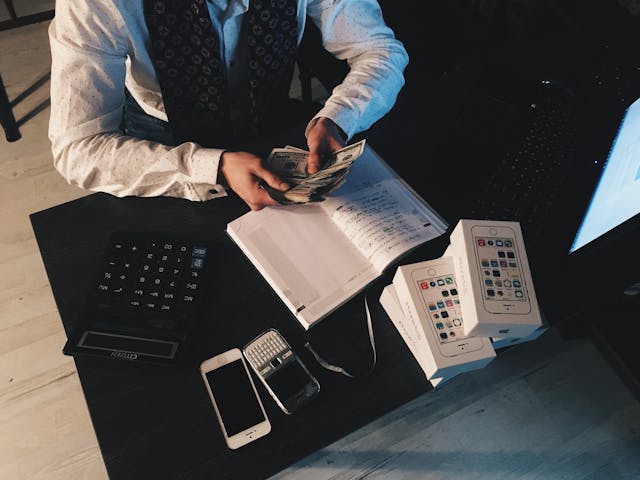

Top Accountant Firms for Photographers: Simplify Your Finances

Know of any other great accounting firms that you’ve worked with? Let us know!

As a photographer, you’re passionate about capturing beautiful moments, but managing the financial side of your business can be overwhelming…right?

Hiring a professional accountant can make all the difference in keeping your business finances organized, compliant with tax regulations, and helping you to become more profitable.

In this blog post, we’ve curated some highly recommended accounting firms that specialize in working with photographers, each offering valuable services to help you streamline your business.

Why Hiring an Accountant Is Helpful for Photography Businesses

Running a photography business involves more than just taking photos and booking clients.

We all know this 🙂

It could be pretty easily argued that photographer’s actually spend just 5% of their time shooting, with the other 95% of their time spent to working on their business.

As your business grows, the financial aspects become increasingly complex, and that’s where a professional accountant can help.

Here are a few key reasons why hiring an accountant is beneficial:

- Tax Planning and Compliance: Accountants ensure your business is compliant with tax laws and help you make the most of tax deductions, ultimately saving you money.

- Financial Organization: Keeping track of expenses, income, and business assets can be challenging. Accountants help organize your finances, so you always have a clear picture of your business’s financial health.

- Profitability and Growth: Accountants can offer insights into where your business can cut costs, invest smarter, and improve cash flow, leading to more profitability and sustained growth.

- Time Savings: Handling your business’s finances takes time away from doing what you love—photography. By outsourcing this work to an expert, you can focus on growing your creative services.

Our Recommended Accountants for Photographers

1. Engage CPAs

Engage CPAs is an accounting firm known for its expertise in working with creative professionals, including photographers. With a team that understands the unique challenges faced by photographers, Engage CPAs can help you with tax preparation, bookkeeping, and financial planning, ensuring that your business stays on track.

We have worked directly with Engage CPAs for many years, and they have helped us navigate many difficult times in our businesses and personal lives including the 2020 pandemic, opening a new business (Shoot and Thrive!), starting a family, investment strategies, tax optimization strategies, restructuring as S-Corps, and more. They make money matters a lot easier to digest!

Why Photographers Like Them:

- Specializes in working with creative businesses, making them familiar with the financial challenges of photographers.

- Offers tax planning services to help you minimize your tax liability and make the most of deductions.

- Provides clear financial reports and actionable insights to help your business grow.

2. Bastien Accounting

Bastien Accounting is a boutique accounting firm that provides personalized services to creative professionals and small businesses. Their team focuses on helping photographers with everything from bookkeeping and tax preparation to financial forecasting. Bastien Accounting prides itself on offering custom financial solutions tailored to your business’s specific needs.

While we have not directly worked with them, we have read many positive things online from others who have!

Why Photographers Like Them:

- Offers personalized bookkeeping and tax services, tailored to fit your unique business model.

- Helps photographers set financial goals and create realistic financial plans for achieving growth.

- Provides year-round support, making it easy to stay on top of your financial situation at all times.

3. Tidy Books Boutique

Tidy Books offers bookkeeping and financial organization services designed to take the stress out of managing your business’s day-to-day finances. While they specialize in small businesses, Tidy Books understands the challenges photographers face in managing cash flow, taxes, and expenses. Their team helps photographers keep their books organized, ensuring nothing falls through the cracks.

Keep in mind, Tidy Books is not a full accounting/CPA firm – but specializes exclusively in bookkeeping (tracking your expenses and sales). They offer services to help you get this set up on your own, or fully managed solutions.

Why Photographers Like Them:

- Provides customized bookkeeping services to keep your financials neat and organized.

- Focuses on simplifying financial processes, making it easier for photographers to stay on top of their numbers.

- Helps you stay tax compliant by keeping meticulous records, ensuring accurate financial reporting.

4. Collective

Collective is the first all-in-one financial solution exclusively for solopreneurs. They currently work with over 1,000 photographers as clients!

One thing that makes Collective unique in this list of recommended accounting firms is that you can sign up for a monthly membership that includes: LLC and S Corp formation, payroll, monthly bookkeeping, quarterly tax estimates, annual tax filing, and access to a team of experts.

This gives photographers peace of mind, maximizes their profits, and gives time back to focus on growing their business.

Why Photographers Like Them:

- Save money: Members save on average $10,000* a year structuring their business as an S Corp.

- Save time: Unlock more billable hours – Collective handles the numbers so you can focus on your business

- Your finance team: Take the solo out of solopreneur – your very own finance team of seasoned professionals

- All-in-one solution: The tools, technology, and team you need to power your business, all under one login

*Based on the average 2022 tax savings of active Collective users with an S Corp tax election for the 2022 tax year

Sign up for Collective using promo code THRIVE to get 1 month free!

DIY Accounting and Bookkeeping vs. Working with a Professional

Photographers often face the dilemma of handling accounting and bookkeeping themselves or hiring a professional. Here’s a breakdown of the pros and cons of each approach:

DIY Accounting and Bookkeeping:

Pros:

- Cost Savings: Doing your own bookkeeping and accounting can save money on professional fees.

- Control: You maintain complete control over your financial data and processes.

- Learning Opportunity: You gain a deeper understanding of your business’s financial health.

Cons:

- Time-Consuming: Managing finances can take valuable time away from photography and other business activities.

- Risk of Errors: Without professional guidance, mistakes can occur, leading to costly errors, especially during tax season.

- Limited Financial Insights: DIY accounting may not provide the in-depth financial analysis that can help your business grow.

Working with a Professional Accountant:

Pros:

- Expertise: Accountants bring specialized knowledge that ensures your business remains compliant and financially sound.

- Time Savings: Delegating financial tasks to a professional frees up your time to focus on growing your business.

- Financial Strategy: Accountants can provide valuable insights into improving profitability, reducing costs, and planning for future growth.

Cons:

- Cost: Hiring a professional accountant can be a significant expense, especially for small businesses.

- Less Direct Control: You’ll need to trust your accountant with important financial tasks and decisions.

Ultimately, if your business is growing or you find yourself struggling to manage your books effectively, working with a professional accountant may be the best option for long-term success.

Learn How Paying Accounting Firms Works

When hiring an accounting firm, it’s essential to understand the common pricing structures to ensure the services fit your budget. Here are the most common ways accounting firms charge for their services:

1. One-Time Fees

For specific services like tax preparation or setting up your bookkeeping system, accounting firms often charge a one-time fee. This pricing method is straightforward and ideal for one-off projects, such as filing annual taxes or conducting a financial review.

Best For: Photographers needing occasional services or one-time assistance, like tax returns or setting up a bookkeeping system.

2. Hourly Rate

Some accounting firms charge an hourly rate for their services. This can be common for ongoing consultations or ad-hoc financial advice. The hourly rate can vary depending on the accountant’s experience and location.

Best For: Businesses needing occasional help without the commitment of long-term contracts.

3. Retainer Fees

Many firms offer retainer agreements, where you pay a set monthly subscription fee in exchange for ongoing accounting services. This often includes bookkeeping, financial reporting, tax preparation, and more comprehensive financial management. Collective is a good example of an accounting firm for photographers that does this.

Best For: Photographers who need consistent, ongoing support to manage their finances year-round.

4. Package Pricing

Some accountants offer package deals that include several services, such as bookkeeping, tax preparation, and financial planning, for a bundled price. This can offer cost savings compared to paying for each service separately.

Best For: Photographers looking for all-in-one financial services at a predictable cost.

Understanding how your accountant charges for services will help you choose the best firm for your budget and business needs.

Custom vs. General Accounting Services: What’s the Difference?

When choosing an accounting firm, it’s also good to know the difference between custom accounting services and general bookkeeping solutions:

- Custom Accounting Services: Firms that offer custom services, like Engage CPAs and Bastien Accounting, work specifically with photographers and other creatives, tailoring their services to meet industry-specific needs. This often includes specialized tax strategies, personalized financial planning, and deep industry knowledge that can help your business thrive.

- General Bookkeeping Solutions: General firms may offer broader bookkeeping and tax services without focusing on industry-specific concerns. While these can be more affordable, they may not offer the in-depth advice and strategic planning you may want.

Choosing a custom accounting service ensures your accountant understands your business model, helping you make the most of available financial strategies to grow your business more efficiently.

Conclusion

Hiring the right accountant is an investment in your business’s future.

Whether you’re looking for tax assistance, help with financial organization, or strategic advice to grow your photography business, the firms listed here can help you succeed.

By outsourcing your financial management to professionals, you free up time to focus on other aspects of your business (the funner ones, right?!) while ensuring that your business remains financially sound and ready for growth.

Honesty is a cornerstone of Shoot and Thrive, so we want you to know that some links in this post are affiliate links. This means we may earn a commission if you make a purchase—at no additional cost to you. We only recommend products and services we trust, have used ourselves, or have thoroughly researched based on industry feedback. Our goal is to provide solutions that genuinely help, whether they come from our direct experience or the collective knowledge of the photography community.

As photography business educators, we believe it's important for educators in this industry to be active photographers themselves. The images used throughout this website were taken through our photo studios - Hand and Arrow Photography and Marshall Scott Photography, except for stock images or if otherwise noted.

Turn Your Passion into a Thriving Business

Transform your photography business into a streamlined, profitable venture that gives you more time, freedom, and confidence.

With the Photography Business Academy, you’ll have a step-by-step guide to building the business—and life—you’ve always dreamed of. From branding to marketing, finances to client experience, we’ve got you covered.

Navigation

Shoot and Thrive is an ethically created resource for photographers needing mentorship, coaching, or business education. We believe in creating content that’s easy to digest and retain while incorporating educational best practices, so you gain clarity and confidence as a business owner.